Key Points:

- Despite a fall in discretionary household spending, some economists think inflation could rise as labour costs increase and unemployment holds steady

- China’s deflation impacts Australian commodities, as mining turnover takes a hit (down 18.1% YoY) despite a significant rise in Chinese coal imports

Global Cash Rates & Inflation

- The Reserve Bank of Australia (RBA) Cash Rate sits at 4.1%, as inflation eased in the year to the June quarter to 6%.

- The UK cash rate sits at 5.25, to fight an inflation rate of 7.9% in the year to June.

- The US cash rate (policy rate) is currently between 5.25-5.5%, and the annual inflation rate in the year to August is 3.2%.

- The ECB Cash Rate (deposit facility) is 4%, raised 25 basis points last week in a bid to fight an annual inflation rate of 5.5% in the year to June.

Inflation Fears Remain Despite Spending Downturn

On Tuesday, the Australian Bureau of Statistics (ABS) revealed the Monthly Household Spending Indicator, which saw spending on discretionary goods and services down for the third month in a row, dropping by 0.7% – but inflation fears remain.

While growth in non-discretionary spending rose 4.2%, it’s clear the rising cost of living is starting to take effect, as consumers battle a 400 basis point jump in rates (from a time when they were close to zero).

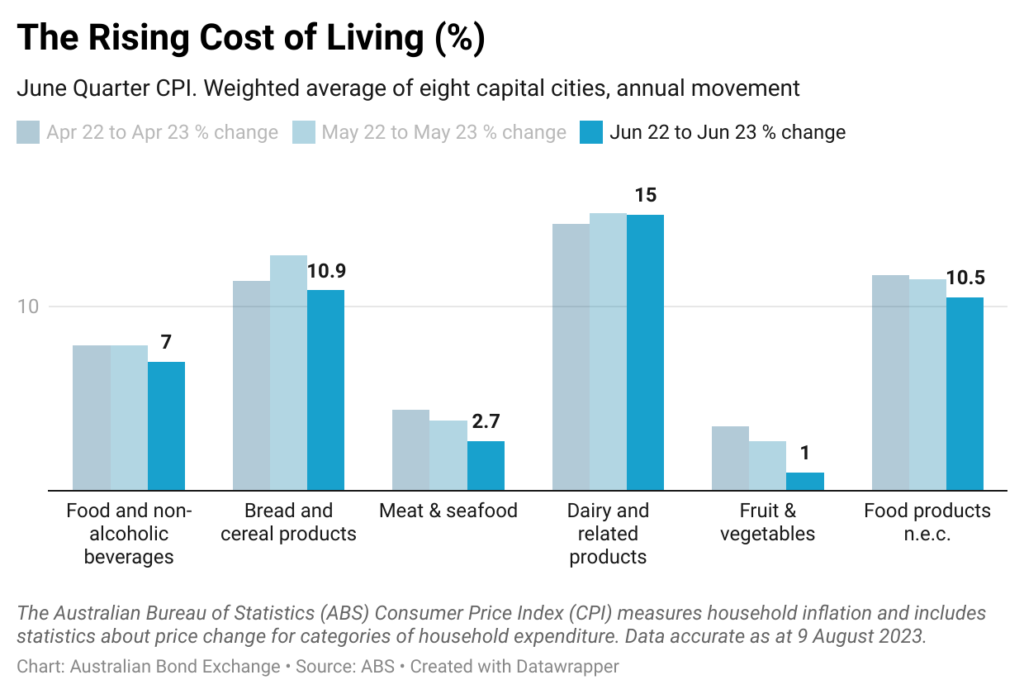

Looking closer at the jump in prices of certain goods, like dairy products that rose 15% in the year to the June quarter, it’s clear many are needing to find more than an extra 4% just to cover groceries. There is also the need to consider the lag between monetary policy tightening and its effect on economic activity.

Economists suggest inflation could return

Though the “lucky country” has proven resilient thus far (in terms of avoiding a recession) AMP Capital’s Chief Economist Shane Oliver makes an important point. There is still a chance that low unemployment in Australia could foster economic growth before it returns to the RBA’s target range of 2-3%, risking a rise to inflation.

This concern was supported by NAB, in comments throughout their July business survey released this week, which outlined the impact of recent wage increases on business labour costs.

“Labour cost growth rose sharply in July, likely reflecting wage rises taking effect,” said NAB Chief Economist Allan Oster. “The reality is that firms’ pricing decisions are affected by many factors, including costs, the strength of demand, and the broader economic outlook,” Oster continued. “Upside pressures to inflation remain considerable, despite the improvement in the Q2 CPI release.”

The next release (on the 25th October) will show data for the September quarter, and provide further insight into whether the rate rises have done their job, or whether these inflationary pressures will see the CPI rise again.

Ore-ful Results: China’s Slowdown Rocks Mining Sector

This week, the ABS also released the Monthly Business Turnover Indicator, which showed the resilience of the Australian economy is highly dependent on the performance of other countries.

Although a double digit increase in the electricity, waste, water and gas industries (12%) was notable, this was expected and attributed to the cooler weather.

What’s most interesting in the data released on Wednesday, and perhaps will have the most significant impact on the economy, was the fact that mining turnover was down 18.1% in the year to June. Despite monthly turnover rising slightly (2%), the mining sector recorded the largest fall in turnover across the 13 industries the ABS includes in the release. Driven by falling iron ore and coal prices and a significant drop in export earnings, which was forecast by economists over a month ago, what cannot be ignored is the impact a slowing Chinese economy is having on Australia. In fact, just a few weeks ago, the Australian Financial Review reported 4.6million tonnes of BHP ore awaiting sale in China.

China’s impact on this downturn was confirmed this week, as data showed exports dropped almost 15% year on year. Unlike western economies battling with high inflation, China is deflating, recording a 0.3% drop in inflation in the year to July.

While there are signs China will hold Australian commodities in a strong position, like the 67% increase in coal imports in comparison to the same period last year, a shift to renewable energy to battle soaring global temperatures, may mean Australia needs to find other ways to drive export earnings, like investing more heavily in lithium.

What’s coming up?

- Next Tuesday, the RBA will release the minutes from the August meeting here, where they chose to hold the cash rate at 4.1%.

- Also next Tuesday, the ABS will release the Wage Price Index data here, which will likely support NAB’s insights into the rising the cost of Labour

- On Wednesday (Thursday Australian time), the Office for National Statistics will release the latest UK inflation data, via the monthly CPI release here.

- On Thursday, the ABS will release the latest data on the Australian unemployment rate here, which stuck at a 50-year low of 3.5% in June.

*Data accurate as at 10.08.2023

Written on behalf of the Australian Bond Exchange.

Leave a Reply